UAVs in Canada – Key Exposures to Loss and Ways to Protect Yourself

This article was written by Mark Sampson for the Association of Ontario Land Surveyors. Mark’s contact details are at the bottom of the article and here is a direct link.

Drones are referred to interchangeably by various names: Unmanned Aerial Vehicles (UAVs) or Unmanned Aircraft Systems (UAS). They are a growing part of the surveying profession. Transport Canada regulates the use of all aircraft, manned or unmanned. UAV users are considered pilots and as such, are legitimate airspace users.

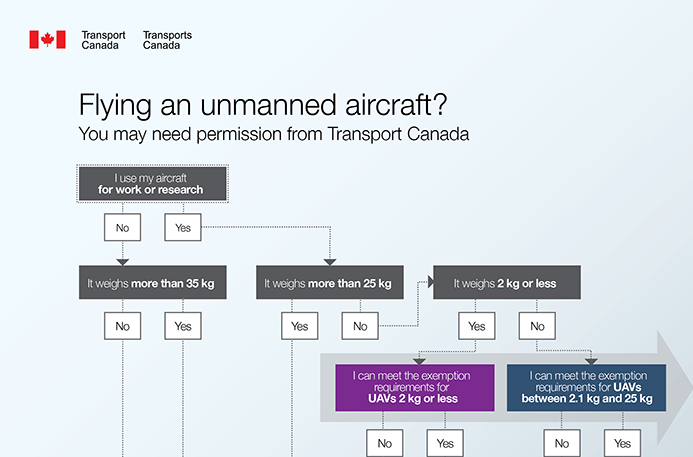

The Canadian Aviation Regulations define a UAV as “a power-driven aircraft, other than a model aircraft, that is designed to fly without a human operator on board and is required to operate in accordance with a Special Flight Operation Certificate (SFOC)”. In November 2014, Transport Canada issued two exemptions to the SFOC requirements and guidance material for lower risk UAVs operating within specific conditions and weighing 25kgs or less. (Source: Transport Canada – CARAC Activity Reporting Notice #2015-012 Date May 28, 2015).

These exemptions are valid until December 2016, as they are meant to be a temporary solution until Transport Canada introduces further regulatory requirements.

Regardless of the use (recreational or non-recreational), or the weight (+/- 25 kg), UAVs are operated in airspace and as such, have unique exposures to loss. The typical insurance policies carried by surveyors (professional liability, general liability, automobile, or property insurance), do not cover damage to, or damage caused by UAVs while airborne. A surveyor who employs a drone must obtain a specific Aviation Hull and Liability Insurance Policy.

Key Exposures to Loss when owning and/or operating a UAV

- Aviation Liability

The most significant exposure to loss to a survey firm when owning or operating a UAV is the potential of the drone causing injury to a person or causing damage to property. An example of this exposure is a surveyor operating a UAV and it crashes to the ground. The best case scenario is that the drone falls from the sky and only damages itself. The worst case scenario is that the drone hits and injures a person or damages property, or both.

A mechanical failure or operator error could cause the drone to crash into a building and cause a fire. The surveying firm could be sued for damage to the structure, the contents within the building, and the potential loss of income from the interruption of operations within the building.

Aviation liability insurance is a third party coverage that is designed to protect the individual or surveying firm from actions that you have negligently caused that injures someone (bodily injury), or something (property damage).

More specifically, bodily injury includes physical injury sustained by a person including mental anguish and death. Property damage includes physical injury to tangible property, including loss of use of that property.

Transport Canada requires firms that operate UAVs to carry minimum aviation liability coverage of $100,000. However, I would recommend that all survey firms carry at least $1 million of coverage. Based on the potential liability exposures associated with operating drones, I would strongly suggest you obtain a quote to increase your coverage to $2 or $5 million. The cost to increase the liability coverage to a higher amount is not as costly as you may think.

- Physical Damage to the UAV

The cost of UAVs designed for the surveying profession represent a significant financial investment for your firm. There are many examples of drones being damaged:

- While airborne – collision with transmission lines, trees, buildings, wildlife, etc.

- During landing – mechanical failure, operator error, inclement weather, etc.

- On route to the jobsite – the drone is damaged while being transported to the jobsite in an automobile collision.

In addition, there is a risk of the drone being stolen either from a truck (field crew stops for a coffee and the truck is broken into), or from a break-in at the office where the UAV is stored.

Transport Canada does not require the individual/firm to insure the physical damage to the drone or its component parts, however based on the common loss scenarios listed above, I believe it is wise to protect your asset by purchasing an insurance policy.

The typical property insurance policy will not cover equipment while airborne, therefore I recommend that surveyors obtain a policy specifically designed to insure the UAV hull and its component parts, i.e., ground station equipment and apparatus, mounted camera, surveying and sensing equipment, spare parts, and batteries, etc.

The physical damage coverage for a UAV includes direct, physical and accidental loss or damage to all or part of the property insured. If there is damage to the UAV, then a typical hull aviation insurance policy will pay the least of the cost to repair the physical damage, the insured value, or the actual cost to replace the UAV with an aircraft of the same make and model. Make sure that the total insured value includes any additional modifications that you make to the vehicle which increase its value.

- Personal and Advertising Injury including Privacy Liability

UAVs collect a wide variety of images and data. There may be an exposure for a surveyor who unintentionally collects private material and causes an injury to a third party. Personal and advertising injury means injury, including consequential bodily injury, that arises out of oral or written publication of the material that:

- Violates a person’s right of privacy

- Slanders or libels a person or organization, or disparages a person’s or organization’s goods, products or services

- Infringes upon another’s copyright, trade dress or slogan in your advertising

A typical aviation liability policy does not automatically include coverage for personal and advertising injury liability. Based on the nature of the operations of a surveyor, it is a good idea to insure this exposure.

A third party can bring a legal action against you claiming a violation to their right of privacy (groundless or not). If you do not have personal injury coverage included as part of your insurance program, then you will not have the protection of an insurance policy to defend you. One of the advantages of transferring this exposure to an insurance company is that it will pay for the cost to investigate and defend you from suits brought against you by third parties.

Ways to protect yourself: Risk Management and Insurance

- Risk Management

There are many inexpensive and easily attainable risk management solutions to help surveyors operate UAVs safely:

- Training – attend a UAV specific ground school training course that will help the operator understand the hazards and operate the vehicle safely

- Safety Management Systems – pre-flight checklists, logbooks and standard operating procedures

- Maintenance – ensure that the drone, ground equipment and systems are inspected and are safe for operation

- Weather – operate in safe weather conditions

- Environmental Hazards – limit the proximity to people, airports, congested areas and government facilities

- Privacy Issues – operate in a reasonable and ethical manner

- UAV Insurance Protection designed for Surveyors

In addition to the risk management techniques outlined above, surveyors can protect themselves by transferring some of the exposures of owning and operating a UAV to an insurance company by purchasing an aviation hull and liability policy.

Many businesses and industries are using drones in their daily operations; however, not all are as professional as the surveying industry. With this knowledge, I have developed a UAV insurance program specifically designed for surveyors. It is competitively priced and contains broad coverage for aviation liability, physical damage to the UAV, component parts and payload (camera, etc.), and personal and advertising injury liability.

There are many exclusions and limitations contained in an aviation insurance policy. If you currently have an aviation policy covering a drone, or will be purchasing a UAV in the future, please contact me and I will give you professional advice on how to best protect you/your firm from these many exposures to loss.

Please remember that not all insurance policies are created equal.

First printed in the Ontario Professional Surveyor, Volume 59, No. 2, Spring 2016.

Reference: Transport Canada – CARAC Activity Reporting Notice #2015-012, May 28, 2015

http://wwwapps.tc.gc.ca/Saf-Sec-Sur/2/NPA-APM/doc.aspx?id=10294

Mark Sampson, BBA, FCIP is the Senior Vice President of The CG&B Group, part of Arthur J. Gallagher Canada Limited. He can be reached by phone at 905-948-2631 or by email at Mark.Sampson@cgbgroup.com