Canada was one of the world’s earliest spacefaring nations, but it now faces a crucial choice: modernize how it engages with private space companies or risk falling behind in the rapidly evolving global space economy.

A new white paper from NovaSpace and Space Canada delivers a blunt message: that Canada is being left behind — not due to a lack of talent or innovation, but because of outdated policies, fragmented procurement, and missed opportunities to empower its commercial space sector.

Canada’s commercial space sector is being held back by systemic gaps in government support and policy, and despite a strong innovation base and increasing investments, Canadian companies are not competing on a level playing field internationally.

Titled “Enabling Commercialization of Space in Canada,” the report argues that the government must act decisively to modernize procurement practices, shift toward long-term commitments, and better position itself as an anchor customer for space services developed by domestic companies.

“Canada has the ingredients for success — a skilled workforce, active research institutions, and vibrant private companies — but the current framework leaves them at a disadvantage compared to international competitors,” the report warns.

Strong Sector, But Missing Momentum

Canada’s space industry is described in the report as “diverse, innovative, and deeply embedded” across the country, with more than 200 organizations active in fields ranging from Earth Observation and satellite communications to space situational awareness and cybersecurity.

Small- and medium-sized enterprises (SMEs) make up 93% of Canadian space companies, and business expenditures on R&D (BERD) reached $593 million in 2022 — more than double the 2015 figure.

Small- and medium-sized enterprises (SMEs) make up 93% of Canadian space companies, and business expenditures on R&D (BERD) reached $593 million in 2022 — more than double the 2015 figure.

Yet many companies are developing advanced technologies without adequate support to transition them into the market. The report notes that the commercial space sector is “increasingly characterized by a bidirectional relationship between industry and government,” but existing mechanisms often fail to capitalize on this potential.

Four Roadblocks to Commercialization

Other nations have faced similar challenges, but many have overcome them by rethinking how governments support and procure space services. The report identifies four major challenges that are limiting the commercialization of space products and services in Canada:

- Technology Orphans and Short-Term Funding: Funding programs focus on early-stage R&D, with limited support for mid- and late-stage development. This creates “technology orphans,” where innovations stall before they can reach commercial maturity.

- Lack of Government Coordination: Procurement processes are fragmented across departments, with few unified strategies or timelines. The report points to a “lack of coordination between government departments in Canada, creating inefficiencies and misaligned priorities.”

- Slow and Rigid Procurement Processes: Canadian procurement timelines do not align with the fast-paced commercial environment. Moreover, there is no formal “Buy Canadian” directive, meaning local firms are often overlooked in favor of established foreign providers.

- Unequal International Competition: “Canadian space companies do not receive the same level or form of support as their international competitors,” the report states. Foreign companies benefit from fast-tracked grants, long-term contracts, and anchor customer arrangements, all of which give them an edge in attracting investment and scaling operations.

Earth Observation: A Missed Opportunity with High Potential

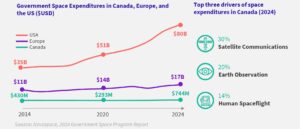

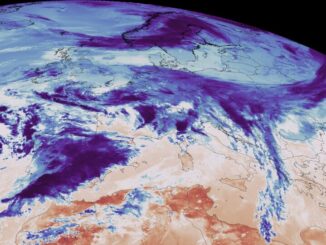

One area where these challenges are particularly evident—and where urgent action could yield immediate results — is Earth Observation. Among Canada’s top three areas of space spending, Earth Observation (EO) accounts for 20% of the 2024 federal space budget. EO data is essential to public missions such as wildfire monitoring, climate change tracking, Arctic surveillance, and disaster response.

Despite its importance, the white paper identifies a major gap: Canada currently has no formal mechanism to acquire commercial or international EO data, even though this was a specific recommendation in the federal government’s 2022 EO strategy, Resourceful, Resilient, Ready.

Instead, the government’s flagship EO initiative, RADARSAT+, announced in 2023, continues Canada’s investment in sovereign capabilities — funding a fourth RADARSAT Constellation Mission satellite and launching a design study for a next-generation system. But it notably excludes provisions for purchasing commercial EO data.

The report argues that this is a missed opportunity. Canada could better meet growing EO data needs while stimulating domestic industry by adopting a program modeled on NASA’s Commercial SmallSat Data Acquisition (CSDA).

Key components would include:

- Pilot contracts to allow vendors to demonstrate capability and refine offerings.

- Clear evaluation criteria for data quality and accessibility.

- Multi-year funding through structured procurement vehicles such as IDIQ contracts.

- A repeatable onboarding process for integrating new data providers.

“By sourcing commercial EO services alongside sovereign assets,” the report notes, “Canada could significantly expand its data portfolio and technical capabilities, reduce redundancy, and stimulate domestic industry participation.”

This is something we had recently highlighted in one of our articles: The Strategy for Satellite Earth Observation, released in 2022, was meant to align EO with Canada’s climate, economic, and innovation goals. But there’s no formal structure to make it happen, no dedicated funding, and no public tracking of progress.

Learning from Global Leaders

While much attention is given to the United States, the white paper also emphasizes that Europe provides valuable examples of scalable, adaptable commercialization strategies.

United States

The National Geospatial-Intelligence Agency’s (NGA) Luno program is a standout model. With a $490 million budget, Luno contracts commercial EO satellite providers and analytics firms to deliver intelligence and national security insights. The program builds on earlier pilot initiatives and integrates commercial capabilities into what was once a fully government-operated domain. The report highlights Luno as a key example of how long-term, defense-scale contracts can rapidly scale private sector innovation and ensure strategic data access.

The Space Development Agency (SDA) is another model highlighted for its rapid acquisition cycles and openness to companies of all sizes. “The model has reduced the time from contract award to satellite launch to as little as 27 months,” the report notes.

Europe

The ESA Moonlight initiative invites commercial companies to develop lunar communications and navigation services, with ESA acting as an anchor customer. Importantly, selected firms retain the ability to market their services to other customers. The white paper calls attention to ESA’s use of feasibility studies and pilot phases, allowing companies to refine both their technical and business models before full implementation.

The ESA LEO Cargo Return Service project and EUSST Commercial Data Procurement program are also cited as key examples of European space agencies using commercial procurement models to support national goals — while opening opportunities for private sector growth.

Four Policy Shifts to Unlock Commercial Growth

To overcome its commercialization challenges, the white paper proposes four key actions:

- Enable Technology Demonstration: Introduce pilot programs and procurement phases that allow companies to test and qualify their technologies—what the report calls “the ability to test their technologies (in space).”

- Position Government as an Anchor Customer: Shift away from government ownership and instead contract companies to provide services, creating stable demand that attracts investment and enables scalability.

- Streamline Procurement Timelines: Modernize processes to align with commercial needs, including reducing delays and decentralizing decision-making where appropriate.

- Shift to Long-Term Commitments: Move beyond short-term, project-specific grants to multi-year contracts with predictable funding—“providing reliable/stable support,” as the report puts it.

The Canadian space sector is clearly at a crossroads. With space increasingly seen as a domain of both economic opportunity and national security, the stakes are high. Countries that adapt their policies to support commercial growth are securing their leadership in the next era of space.

“By positioning the government as an anchor customer through commercial service procurement, Canada can overcome its commercialization roadblocks [and] create a sustainable private space sector,” the report concludes. “Embracing international best practices will help drive commercial growth, support national interests, and solidify Canada’s standing as a leader in space and innovation.”

Be the first to comment