Canada’s space sector entered 2025 without a new national strategy or a single defining announcement. It ends the year in a different place nonetheless. Across budgets, international commitments, Earth Observation investments, and industry assessments, space was drawn more firmly into Canada’s economic, security, and infrastructure priorities.

This was not a year of expansion so much as alignment. Government intent became clearer, defense and dual-use considerations more explicit, international partnerships more formal, and commercial pressures harder to ignore. The result was a sector that moved closer to the center of national planning, even as the structures needed to support long-term growth remained uneven.

As the year closed, industry concerns became harder to ignore. A new Space Canada position paper points to procurement as a growing risk to Canada’s space competitiveness. The timing was new; the argument was not. Similar concerns had been surfacing throughout 2025.

Taken together, these shifts point to a deeper issue around sovereignty, understood less as ownership and more as control over access, continuity, and decision-making in systems Canada increasingly depends on.

A Sector Holding Steady, With Signs of Change

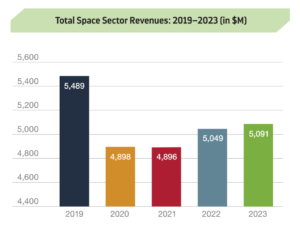

The Canadian Space Agency’s most recent State of the Canadian Space Sector report, based on 2023 data and released in November, outlines the sector’s current position.

The topline numbers tell a story of stability. The sector’s contribution to GDP reached a record $3.4 billion. Direct employment rose to just under 14,000 jobs, and business R&D spending climbed again to $650 million, the highest level on record. Those gains stand out in a year when many technology sectors were under pressure. At the same time, total revenues held largely flat at just over $5 billion.

Export growth made up for a drop in domestic revenues, and the long decline of satellite broadcasting continued to drag on the numbers. Growth showed up elsewhere — navigation, Earth Observation, space exploration, and upstream manufacturing all moved in the right direction — but not yet at a scale that reshapes the overall revenue base.

The sector is holding its ground, while still looking for its next growth engine.

Commercial Reality Check

That tension between capability and scale was spelled out more bluntly earlier in the year in a Novaspace report highlighted by GoGeomatics. The analysis turned attention to the gap between technical strength and sustainable business outcomes.

The challenges are familiar to anyone working in the sector: limited access to anchor customers, procurement that is slow or fragmented, and long gaps between public investment and commercial return. Many Canadian firms build strong technology, yet remain confined to pilots and early deployments, particularly in a domestic market that is small and risk-averse.

This places the CSA’s data in a broader commercial context. A sector can be innovative, export-oriented, and growing its workforce, while still feeling commercially constrained. In 2025, that contradiction sat at the centre of Canada’s space economy.

CSA Spending: Continuity, Not Surprise

Against that backdrop, federal spending at the Canadian Space Agency offered something the sector values more than novelty: predictability. The CSA’s departmental plan released in mid-June confirmed a record budget of $834 million.

The budget reflects commitments made in 2019 to support lunar exploration and participation in the Artemis program, with continued funding in 2025 for Canadarm3, lunar robotics, and surface mobility systems.

Much of the public attention around these investments has focused on their symbolic value. Their real impact is more practical. They sustain advanced manufacturing, keep high-end engineering teams intact, and ensure Canadian companies remain part of long-running international programs. In a year defined by adjustment rather than ambition, that continuity mattered.

Europe: From Interest to Necessity

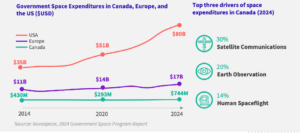

Canada’s relationship with the European Space Agency moved onto firmer ground in 2025. At ESA’s Council Meeting at Ministerial Level, Canada formally locked in a multiyear financial commitment, moving beyond expressions of interest to binding participation.

At the ministerial meeting, Canada confirmed a total investment of €407.71 million (approximately CAD$664.6 million) across European Space Agency programs. This figure includes the CAD$528 million previously announced earlier in the year and formalizes Canada’s participation across multiple ESA program lines.

This matters because ESA ministerials set the agenda for years at a time. Once funding is committed, Canadian companies and research institutions can plan around those opportunities. The programs themselves focus heavily on Earth Observation, navigation, space safety, and secure communications, all areas with clear civilian and defence relevance.

Canada is positioning itself within large, rules-based international systems, where security and resilience are becoming central considerations in space policy.

At GoGeomatics, we had predicted this way back in February 2025.

Earth Observation Moves Into Operations

Another signal of that shift came late in the year with the federal government’s $47-million investment to secure access to essential Canadian Earth Observation data. The funding sits within the broader RADARSAT+ commitment announced in 2023 and places clear emphasis on continuity. It supports long-lead components for a RADARSAT Constellation Mission replenishment satellite, alongside concept studies with Canadian firms to shape what comes next.

The emphasis is on maintaining uninterrupted access to data already embedded in government operations. Earth Observation is increasingly treated as operational infrastructure, supporting federal functions such as emergency response, Arctic monitoring, environmental assessment, and security planning.

WildFireSat Moves Toward Operations

WildFireSat moved closer to operational use in 2025, offering a concrete example of how Earth Observation is being integrated into government decision-making.

In September, Natural Resources Canada released a new WildFireSat e-Bulletin outlining progress on the mission, including its polar-orbiting design, Arctic coverage, and growing research community. The update positioned WildFireSat as an operational wildfire intelligence tool focused on consistent observation and repeat coverage, rather than a purely experimental system.

Earlier in the year, however, the program came under scrutiny about procurement and sovereignty. The Canadian Space Agency’s selection of Spire Global for the WildFireSat contract, through its Canadian subsidiary exactEarth, prompted discussion within the sector about the role of foreign-headquartered firms in delivering data that supports national emergency response.

Taken together, WildFireSat reflects the realities shaping Earth Observation today: urgent operational need, evolving procurement models, and unresolved questions about domestic capacity and control.

Budget 2025: Space, Without Saying “Space”

By the time Budget 2025 was tabled, most of these themes were already visible. What the budget did was make the logic clearer, even when space was not named explicitly.

One of the most telling examples was the decision to fund Canada’s first sovereign launch capability through the Department of National Defence. The amount of $182.6 million was modest by global standards, but the placement was deliberate. Launch was framed as a matter of operational readiness and resilience, not industrial development alone.

The same thinking showed up in the budget’s large investment in modernizing meteorological and forecasting infrastructure. Officially, this was about weather. In practice, it strengthens the country’s ability to ingest, process, and act on Earth Observation and environmental data at speed. That capability underpins everything from flood forecasting to disaster response.

The budget also leaned hard into dual-use innovation. Space, aerospace, and data-driven systems were explicitly tied to security and industrial policy, blurring lines that once kept civilian and defence programs separate. For companies working in Earth Observation and geomatics, this creates new pathways into programs that already matter inside government.

What the budget did not do is just as revealing. There was no new national EO mission announced. No visible update on the National Space Council. Coordination remains distributed across departments, with integration expected to emerge gradually rather than through a single governing body.

Read our analysis of Budget 2025

Looking Ahead to 2026

By the end of 2025, Canada’s space sector had settled into a clearer role. It is economically material, technically credible, and increasingly woven into how the country thinks about security, climate risk, and infrastructure. What has changed most is the context around it. Space now sits within a broader conversation about sovereignty, understood not as isolation, but as the ability to retain control over systems the country relies on when pressure mounts.

At the same time, coherence remains uneven. Procurement pathways are fragmented. Talent shortages persist. Domestic demand is thin, even as exports grow. The pieces are moving, but not yet in concert.

Procurement will be a central test. For years, companies across Canada’s space sector have argued that sustained growth depends on more deliberate domestic procurement, particularly the role of government as an anchor customer rather than a one-off buyer. The concern has been less about access in principle than about structure, including a continued reliance on large primes and long-established incumbents that limits pathways for newer and mid-scale Canadian firms. With sovereignty now an explicit policy objective, questions about how Canada buys — and how consistently it uses procurement to support domestic capability — are moving closer to the centre of space and data policy. The federal government’s recent launch of a Buy Canadian procurement policy sharpens those expectations.

The question heading into 2026 is whether policy, procurement, and workforce systems will align with the role the sector is already being asked to play, and whether government is prepared to act as a sustained anchor customer in practice.

Be the first to comment