Safe Software, the Canadian company behind the FME platform, has expanded into the United Kingdom and Ireland — a strategic move aimed at strengthening its global footprint and accelerating growth across the Europe, Middle East, and Africa (EMEA) region.

With new offices in Dublin and London, the expansion marks a major milestone in Safe’s journey toward its goal of $250 million in revenue by end of 2028. These hubs will anchor customer success and sales operations in Europe, which will allow the company to provide localized support and deepen ties with its growing regional client base.

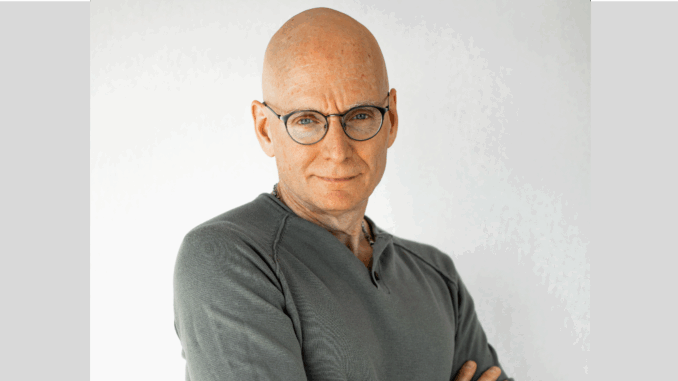

“Our customers are tackling complex, high-volume data challenges across industries, and they rely on our FME Platform — from Form to Flow to Realize — to turn data into action,” said Don Murray, CEO of Safe Software. “By expanding into the UK and the EU, we are strengthening our support and deepening collaboration with partners, ensuring faster response times, tailored solutions, and end-to-end success throughout the entire data journey.”

The new locations will serve as key points of engagement for Safe’s customers and partners across Europe, enabling stronger collaboration and responsiveness. The move is part of a larger strategy to scale the company’s international team and better serve organizations working at the forefront of data integration. Hiring is already underway for a range of roles across both countries.

Despite its global expansion, Safe Software remains firmly rooted in Canada. All core product development continues to be based domestically, with no plans to offshore technology functions. Murray notes that while the European offices may take on expanded marketing responsibilities over time, the company’s innovation and identity will remain Canadian at heart.

We caught up with Don Murray to learn more about Safe’s international expansion, how FME is evolving in the era of AI, and what it means to grow a global tech company from Canada.

Excerpts from the conversation:

Why the UK and Ireland — and why now? Was this expansion always part of the plan, or has it been accelerated by recent momentum in Canada-Europe ties?

We have about 25,000 customers around the world, and Europe, the Middle East, and Africa are neck and neck with the U.S. — it’s a big market, probably 40% of our customer base. But Vancouver is eight hours away from Europe, and that makes real-time, face-to-face interaction with clients difficult.

Every time we travel over there, we have amazing meetings and come back with strong leads. That’s what pushed us to say: we need to be there all the time.

We are setting up customer success in Dublin and sales in London. Europe is so dense — it’s just a short hop on a train or plane to meet with customers. This move will help us grow not just across Europe but also in the Middle East, which is a very partner-driven region for us.

Do you see this as part of a larger global push? Or is it focused just on EMEA?

It’s both. We have a long-term goal: $250 million in revenue by end of 2028. To do that, we need to grow our workforce — not just in Canada, but globally. Europe is the current focus, but we are also looking at a possible office in Toronto — we probably have 10 to 20 people there already.

And globally, we have built out a strong partner network — about 150 partners who resell and support FME across Europe, the Middle East, Asia, and beyond. We have got partners in China, Japan, Malaysia, Australia, New Zealand… and we have localized the product into several languages: German, French, Spanish, Mandarin, Japanese, Hindi — and of course English.

A lot of people speak English as a second language, but when they can work in their native language, they are simply more productive. It reduces the cognitive load — and lets users focus on the real work instead of translating in their head.

Will these offices evolve into innovation hubs?

Right now, development stays in Canada. We have always avoided offshoring. We have incredible Canadian universities — Waterloo, SFU, UBC, across the Prairies — and we hire from all of them. The SR&ED program is great, and it supports that kind of local R&D. So, we have no plans to shift development overseas. We might expand marketing in Europe, since they can tailor messaging to local markets and events. But for innovation? That stays here.

You call FME an ‘All-Data, Any-AI’ platform. What does that actually mean?

It took us a while to land on that. We tried a bunch of taglines. But this one stuck. “All-Data” means we work with every kind of data: spatial, non-spatial, real-time, big data, whatever. “Any-AI” is critical because the best AI depends on the problem. We have seen customers use multiple AIs for a single workflow — like one in the UK, a Workspace Group, needed three AIs to automate a task.

UK Power Networks used Gemini to extract text from documents. Others use Amazon Bedrock. The idea is: you choose the AI, and we will make sure your data can get to it. We are vendor-neutral — and in today’s world, that’s becoming rare. Informatica being acquired by Salesforce just made that list smaller.

Are your customers ready for AI? Or still stuck on the basics?

It’s mixed. Some are all in. Others are wait-and-see. But you can’t talk about AI without talking about data. And the easier we make it for people to use their data with AI, the better. Internally, we are using AI too — for automation, support, even code generation.

What industries are growing fastest for you right now?

Local government has always been big — they are squeezed for resources and always need automation. But the utilities base is really growing: power, telecom, water. No matter what happens in the world, people need electricity and cell service. Our subscription model is growing over 70% year-over-year. We don’t charge per seat; we look at consumption. Customers like that.

Any new or surprising sectors coming up?

Yes, we are going beyond geospatial events now and hitting general data shows. We are seeing interest from insurance, finance, health — all these sectors have messy, disconnected systems. And now we are talking to Chief Data Officers, not just GIS folks. That’s a big shift.

Groceries came up recently too. A partner told us, “You need to be in groceries.” I hadn’t thought about that market, but it makes sense. Big chains face similar data challenges. And once one finds a good solution, others follow.

You have scaled a global company out of Surrey, B.C. What’s worked well, and what’s been difficult about growing from Canada?

Our first customer was the B.C. government, then Manitoba, and then, somehow, the Swedish Land Survey. So, we have been global from early on. But Canada is a hard place to sell. Our Canadian sales are probably under 7%.

Sometimes Canadians undervalue Canadian tech. There’s this mindset that if it’s Canadian, it’s not as good. That kind of mindset is frustrating.

In a recent report on Canada’s space ecosystem, there was sharp criticism that the government doesn’t act as an anchor customer — especially for Canadian-made tech. Do you see that same issue playing out in the broader geospatial and data integration space?

Honestly, I haven’t seen that as a problem in our sector. We have been part of several public initiatives. I’d be wary of governments picking winners. We didn’t chase funding early on — others did, and some of them aren’t around anymore. But programs like SR&ED? That’s great. We have always found Canadian officials helpful and professional.

For us, the bottleneck isn’t funding or sales; it’s talent. We are nearing 400 people. We hired about 70 this year. Finding skilled people is the challenge. That’s where government could step in — support post-secondary education, reduce tuition, help students graduate without crushing debt.

You speak about the challenge of finding skilled talent, and it’s something we hear echoed across the industry. Yet geospatial programs are shutting down at Canadian universities. What’s driving that disconnect?

It’s frustrating. Programs like BCIT, SFU, UBC, and COGS have produced some of our best hires. But I think students just don’t know about the job opportunities. The geospatial sector isn’t always top of mind when students are choosing degrees. We are trying to help by hiring every practicum student we can from BCIT, and we have brought several on full-time. But the awareness gap is real.

We hire people who are curious and driven. We know we will be retraining constantly –technology is moving too fast for anything else. So, we invest in people who can grow with us. Culture travels when you hire right.

Looking ahead, what excites you most about where the data and geospatial industry is headed?

We are moving toward a world of real-time, service-based data — shared over APIs, not files. The infrastructure is evolving, and that’s opening up entirely new ways to interact with data –augmented reality, live dashboards, and beyond. And that means more insight, more efficiency. I am excited to keep pushing those boundaries.

And what’s next for Safe Software?

We are on track for $250 million in revenue by 2028 and growing to 700-800 people. We are expanding in Europe now, and Toronto is next. We will likely look at Asia after that. It’s all about being close to customers, hiring great people, and staying curious.

Be the first to comment