The Grid Wise Alliance (GWA) and Smart Grid Policy Center (SGPC), the research arm of the GridWise Alliance, have created the Grid Modernization Index (GMI), which has been applied to rank U.S. states, based on their grid modernization policies and activities. The GMI ranking system uses a set of criteria to evaluate the progress and impacts of improvements to the U.S. electric infrastructure. This Grid Modernization Index consists of three components:

- Policy – State policies and regulatory mechanisms that encourage grid modernization investment;

- Customer Engagement – Investments in customer empowering capabilities

- Grid Operations – Investments in grid modernization technologies and capabilities. This includes advanced GIS and GIS integration with the asset management system

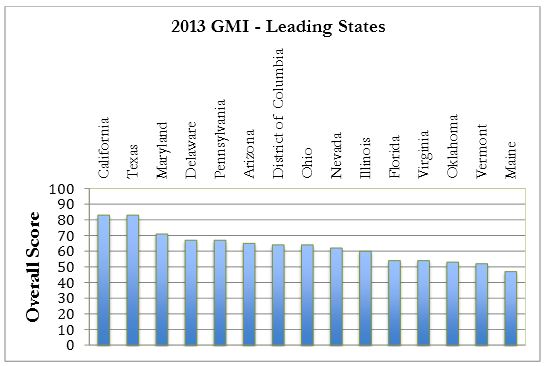

Data was collected for 41 states and the District of Columbia. A report released by the GWA and the SGPC lists the 15 states that scored the highest, based on criteria defined for each of the three component areas.

- California

- Texas

- Maryand

- Delaware

- Pennsylvania

- Arizona

- DC

- Ohio,

- Nevada

- Illinois

- Florida

- Oklahoma

- Virginia

- Vermont

- Maine

The report also identifies some of the common characteristics of the highest scoring states.

The report also identifies some of the common characteristics of the highest scoring states.

- States with retail choice, belong to Regional Transmission Organizations (RTOs) or Independent System Operators (ISOs), and have Renewable Portfolio Standards tend to have hgh GMI scores.

- States that received ARRA Smart Grid Investment Grants tend to have high scores for all three components (Policy, Customer Engagement and Grid Operations) of the GMI.

- No correlation was found between high GMI scores and electricity rates. In other words the price of electricity is not a primary driver for grid modernization.

- States with high GMI scores also score higher in addressing cybersecurity and data privacy than other states.

- States with high GMI scores tend to score higher in engaging customers

- States with high GMI scores tend to deploy more sensors and advanced modeling tools for both transmission and distribution grids.

- The 15 highest-scoring states all have deployed smart meters to some degree to their residential and small commercial customers. Ten of these 15 states have installed smart meters for at least 60 percent of their consumers.

Grid modernization technologies and capabilities

The technologies and capabilities that were considered for the GMI to be part of a modern smart grid include

- Automated Meter Reading (AMR)

- Advanced Metering Infrastructure (AMI)

- Advanced, communicating transmission sensors,such as:

- PhasorMeasurement Units (PMUs)

- Dynamic line rating

- Fault indicators

- Transformer monitoring

Capabilties tha were used to assess states include

- Energy storage is leveraged as a tool for system planning?

- Price-responsive and/or ride-through (voltage and/or frequency) capable microgrids exist ?

- Advanced Metering Infrastructure (AMI) is integrated with other utility systems to increase

benefits, such as outage detection, remote connect/disconnect, tamper detection, power quality monitoring, and more ? - Distributed Automation (DA) deployed at: substations; line switches; circuit ties ?

- Distribution Management System (DMS) functionality is integrated with sensor data, capacitor bank monitoring and/or control, voltage regulator monitoring and/or control, or storage charge and/or discharge?

- Probabilistic planning–based on new data from equipment and sensors – is being used in distribution, transmission, or customer interactions and/or across the enterprise for increased system value?

- “Self-healing” (i.e., to autonomously operate and/or reconfigure) capability is deployed ?

- Advanced Geographical Information System (GIS) capabilities and functionality are deployed ?

- GIS is integrated with Asset Management (AM)?

- Advanced visualization tools are being used ?

Be the first to comment