The American Water Works Association (AWWA) held its annual Annual Conference & Exposition (ACE11) last week in Washington, D.C. It was an amazing experience. There were over 500 exhibitors and on-site attendance was expected to be over 11,000 this year and a number of the talks and presentations were available virtually. This is a North American event with Mexicans and Canadians in attendance in addition to US participants.

Trends in the Water Industry

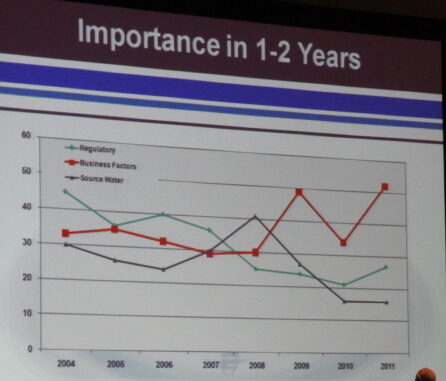

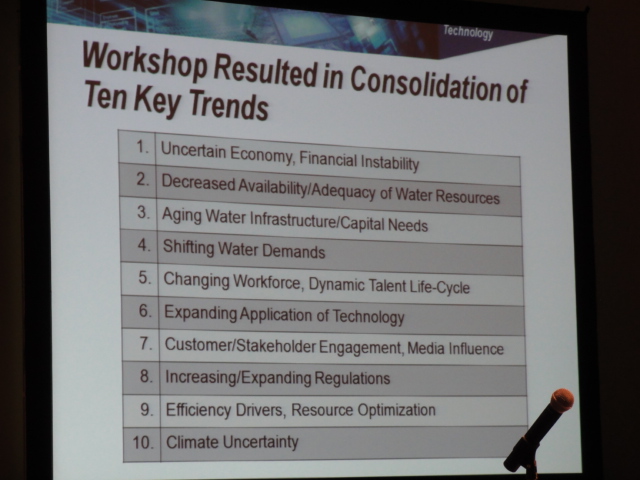

To me the key sessions were a series on the important trends facing the water industry. One of the most important sources of information about trends in the North American Water Industry is the annual AWWA State of the Industry (SOTI) report. This year’s report will be coming out in the fall, but preliminary results from the annual survey of water professionals were presented last week.

The most important issue over the next year or two identified by the survey by a wide margin is business factors.

- business factors (over 50%)

- regulatory (~27%)

- source water (~16%)

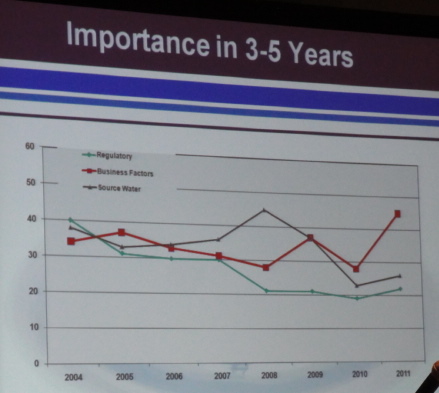

Respondents were also asked to look ahead and identify what they saw as the important issues in the next three to five years. Again about 50% identified business factors as the most important issue.

Respondents were also asked to look ahead and identify what they saw as the important issues in the next three to five years. Again about 50% identified business factors as the most important issue.

Business factor #1

The water industry is unique in the utility sector for a number of reasons. But the most important is that safe drinking water is critical for public health.

Secondly the water distribution network is perceived to be our most important infrastructure network. I know people who after the last ice storm in Ontario didn’t have electric power for a week, some for a month, but it is inconceivable for most of us to go without water for more than a few hours at most.

Thirdly, for most North Americans access to clean water is considered to be a basic right. Americans accept cutting electric power and telephone for non-payment of bills, but cutting water is equivalent to eviction. As a result 90% of US water utilities are government owned and the concept of wholesale privatization of the water industry is not popular. The result is that a significant proportion of North American water is not metered, Chicago is an example, and where it is metered people strongly object to paying for water what they are paying for their cell phone or cable TV. Speaker after speaker reiterated the importance of communications, of making the public aware of how much is involved in providing safe drinking water, as the fundamental problem facing the industry, because until this is solved it will be difficult to find funding to address the challenges facing the industry. Several speakers said federal and state funds can not be expected to address the funding shortfall. In fact there is a serious risk that funding from the federal government could decrease in the future.

Other business factors

Other business factors

Increasing costs

Water infrastructure is capital intensive. In the drinking water industry you need to invest $7 to get a dollar in revenue. Wastewater is even worse, $8 of investment to get a dollar. By comparison in the electric power industry between $1.60 and a $1.70 will get a dollar in revenue. And capital costs in the water industry are going up at twice the rate of inflation.

Aging infrastructure

Secondly It is estimated that 30% of US water infrastructure is old, meaning beyond its rated lifetime. Maintaining old infrastructure is expensive. There are about 700 water main breaks per day in the US costing about $2.6 billion annually to repair. 42 billion gallons of drinking water are produced and delivered every day in the US, of which 7 billion gallons, or 18% is lost through leakage. In addition US water systems consume 56 billion kWh of electric power annually, primarily for pumping, and the annual electric power bill of the water industry is $4 billion. Over 10% of this, 5-10 billion kWh is spent to produce water that is not paid for.

Rate structures

Thirdly, per capita consumption is declining in much of North America, which means that a simple volumetric rate structure is not going to lead to increased revenue for water utilities. A number of alternative rate structures are being tried. As an example, an increasing block rate, which means that the rate per liter or per gallon increases with the more water you use, is used by an increasing number of municipal water systems, because it encourages conservation and provides a mechanism for increasing revenue to the water utility. I’ve blogged about what Atlanta and Houston have been doing to increase water revenue.

Aging workforce

Another serious challenge is the aging workforce. Of the water workforce in the US 37% of water utility workers and 31% of wastewater utility workers will be eligible to retire by 2018. It is projected that employment in the water supply and sanitation sector needs to grow at a rate of 45% in coming years, but the pool of available, technically skilled workers is shrinking. Several talks at the conference addressed the issue of knowledge capture and transfer.

Technology and innovation

The aging workforce, increasing costs and funding challenges are driving an increased focus on efficiency in the water industry, which in turn is driving water utilities to increasingly turn to technology. A related theme that I heard in a number of sessions is the need for the water industry to increase the pace of innovation – this from an industry that has not traditionally placed a lot of emphasis on innovation.

emphasis on innovation.

Increasing regulation

Regulation of the water industry in the US is primarily a local and a federal (EPA) responsibility. In only four states does the state regulate the water industry. There were a number of presentation on the issue of increased regulation, including from senior members of the EPA.

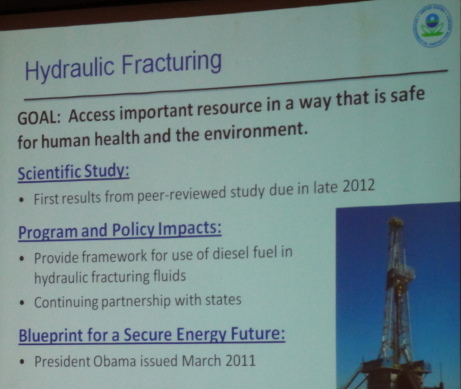

I have blogged about the EPA study currently underway to assess the impact of the shale gas industry, especially fracking, on water quality in the US.

I have blogged about the EPA study currently underway to assess the impact of the shale gas industry, especially fracking, on water quality in the US.

The next major area of increased regulation is volatile organic compounds (VOC), which includes solvents. An area of major concern to the EPA and as a result to the water industry is pharmaceuticals in the water supply, in particular what are referred to as endocrine-altering compounds.

Combined sewer overflows (CSOs) continue to get a lot of attention in the industry not only because of the magnitude of the consent decrees that the EPA has imposed on a number of municipalities, but also because of increasing public awareness of a problem about which Teddy Roosevelt was quoted as saying, “Civilized people should be able to dispose of sewage in an better way than by putting it in the drinking water.“

Sustainability

Sustainability

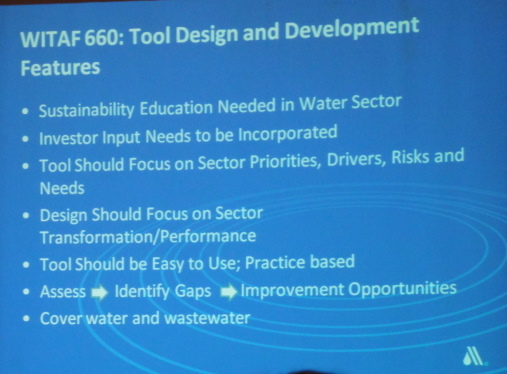

If there was one topic that seemed to recur more than any other, with the exception of funding, it was sustainability. A common thread was the discussion on how water utilities can best adapt to climate change. The AWWA has a Climate Change and Sustainability Technical Advisory Workgroup (TAW) that is investigating developing a sustainability rating tool, dubbed WITAF 660, to measure sustainability in the drinking water industry.

Be the first to comment