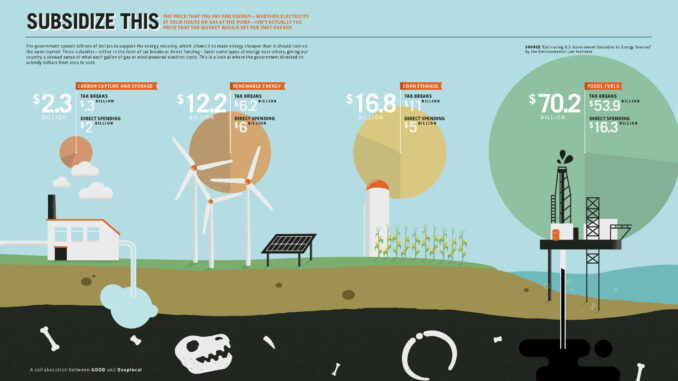

A 2009 study identified the subsidies including direct spending and tax relief for different sectors of the US energy market to the energy industry for the period 2002 to 2008. Most of these are in the form of tax breaks for the fossil fuel sector.

Tax Direct Total

$0.3b $2b $2.3b CCS

$6.2b $6b $12.2b Renewables

$11b $5b $16.8b Corn ethanol

$53.9b $16.3b $70.2b Fossil fuels

In a very interesting op-ed in the Wall Street Journal “Why We Support a Revenue-Neutral Carbon Tax“, George P. Schultz

(Former Treasury Secretary and Secretary of State in Nixon and Reagan administrations) and Gary Becker

(University of Chicago, Department of Economics, 1992 Nobel Prize in Economics), both associated with the Hoover Institution, a conservative American public policy think tank at Stanford University, argue for reducing government involvement in the energy sector by replacing the many subsidies with a revenue-neutral tax on carbon.

- “We should seek out the many forms of subsidy that run through the entire energy enterprise and eliminate them.

- :In their place we propose a measure that could go a long way toward leveling the playing field: a revenue-neutral tax on carbon, a major pollutant. A carbon tax would encourage producers and consumers to shift toward energy sources that emit less carbon—such as toward gas-fired power plants and away from coal-fired plants—and generate greater demand for electric and flex-fuel cars and lesser demand for conventional gasoline-powered cars.

- We argue for revenue neutrality on the grounds that this tax should be exclusively for the purpose of leveling the playing field, not for financing some other government programs or for expanding the government sector. And revenue neutrality means that it will not have fiscal drag on economic growth.”

Schulz and Becker suggest that the tax could be imposed at the point of consumption such as gasoline stations and electricity bills or on production facilities. THey suggest it could be administered by the Internal Revenue Service (IRS) or the Social Security Administration.

They make the case that the tax should be revenue neutral, meaning that it generates no net revenue for the government. The proceeds from the tax would be redistributed to the citizenry as a “carbon dividend.”

Be the first to comment