The electric utility industry in the U.S. is facing challenging times. To put this in context the U.S. is responsible for 1/4 of global CO2 emissions, and the electric power sector is responsible for 1/3 of U.S. CO2 emissions.

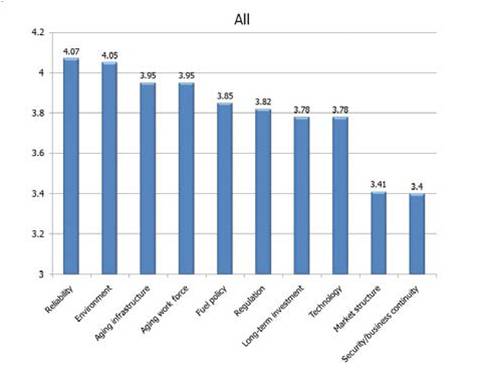

A recent survey, the 2008 THIRD ANNUAL STRATEGIC DIRECTIONS IN THE ELECTRIC UTILITY INDUSTRY SURVEY

for Black & Veatch by Sierra Energy Group, identified some of the top priorities for the electric utility industry, which includes reliability, environment/global warming, aging infrastructure, aging workforce, and fuel policy as the top priorities. If you add trying to forecast energy demand in a rapidly changing economy, you have a pretty good list of what is keeping utility folks up at night.

Electric power demand has been growing about 1 to 2% per annum, but recently there have been signs of a downturn in demand, that could have important implications for utilities if it turns out to be driven by something other than the economic downturn (Wall Street Journal Nov 21, 2008).

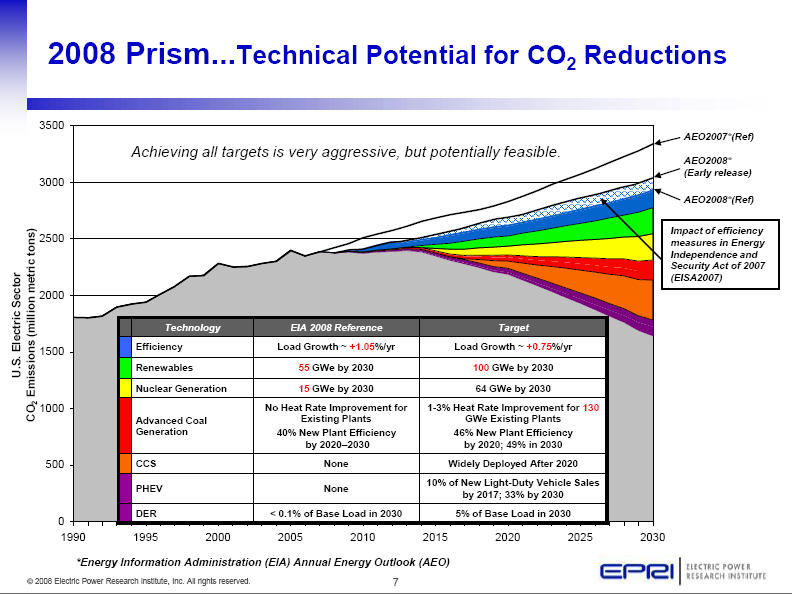

The cost of building electric infrastructure, whether coal, nuclear power, natural gas, or renewable, has been going up. Global climate has motivated the industry to invest in more energy-efficient technology including energy efficiency and demand response (EE/DR) programs, carbon capture and storage (CCS), plug-in hybrid electric vehicles (PHEV), and distributed energy resources (DER).

To try to forecast the impact of these challenges, The Edison Foundation asked The Brattle Group to “examine the total investment that would be required to maintain today’s high levels of reliable electric service across the United States through 2030, net of the investment that could be avoided through the implementation of more aggressive energy efficiency and demand response.” The result was the report Transforming America’s Power Industry:The Investment Challenge 2010-2030.

The scenarios that Brattle was asked to look at are

1) Reference Scenario Basically the Annual Energy Outlook (AEO) forecast published by the U.S. Department of Energy’s Energy Information Administration (EIA), but adjusted for higher fuel ( with oil down to approximately $50/barrel now, this may not be realistic ) and construction costs. Brattle estimated that with this scenario, 214 gigawatts (GW) of new generation capacity

would be required by 2030, which would require an investment of $697

billion under existing EE/DR programs and state renewable programs and

carbon policies.

2) RAP Efficiency

Base Case Scenario: This adds the impact of realistically

achievable potential (RAP) for EE/DR programs, but does not include a

new federal carbon policy.

3) MAP Efficiency

Scenario: This is the maximum achievable

potential (MAP) for EE/DR programs.

4) Prism RAP

Scenario: The Edison Foundation was particularly interested in the investment

required for of one projected generation mix called the “Prism

Analysis”

developed by the Electric Power Research Institute (EPRI), a

nonprofit centre for public interest energy and

environmental research. The EPRI’s Prism Analysis projects the

generation investments in a number of programs and technologies including efficiency, renewables, nuclear generation, advanced coal generation, CCS, PHEV, and DER, that will be required to reduce the growth in

carbon

emissions.This scenario further assumes there is a new federal policy to reduce carbon emissions.

The report predicts that no matter which of these scenarios is followed, the electric power utility industry will require an

investment ranging from approximately $1.5 trillion to $2.0 trillion by

2030. But as I said at the beginning if demand is entering new territory, these forecasts will require a reassessment, because they assume that demand will continue to increase 1-2% per annum.

Be the first to comment