Last week the American Society of Civil Engineers (ASCE) released a new report in the Failure to Act series “Electric Infrastructure Investment Gaps in a Rapidly Changing Environment” that estimates the investment gap through 2039 for electric power infrastructure in the U.S. and assesses the impact of under investment in electric power infrastructure on the U.S. economy. Modern economies are increasingly dependent on “chip technologies” powered by electricity. Recent projections suggest that ICT consumption of electricity could reach over 20% of total demand by 2030 with data centres consuming over a third of that. It is estimated that the average cost of an outage at a data centre is about $8,851 for every minute the electricity grid is disrupted,

Background

Just about everything that we use daily from phones and the internet to water and wastewater rely on electric power. In addition as we reduce the carbon footprint of the economy, electric power becomes increasingly important because in most jurisdictions electric power has a low or decreasing carbon footprint compared to other sources of energy.

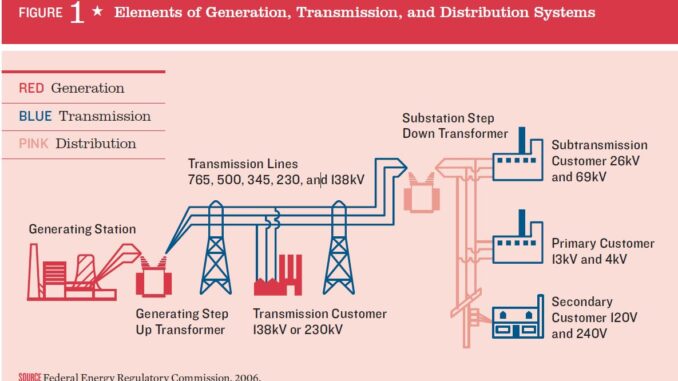

The U.S. electric power grid is composed of the bulk power system including large-scale generation facilities and the transmission network. 10,000 power plants comprise the generation capacity of the U.S., not including residential solar panels or small-scale wind farms. More than 600,000 circuit miles of transmission lines, of which 240,000 are high-voltage, carry power from generation plants to the distribution nrtworks. An estimated 5.5 million miles of local distribution lines (including underground cables) carry the power to end users.

Increased ICT consumption of electricity

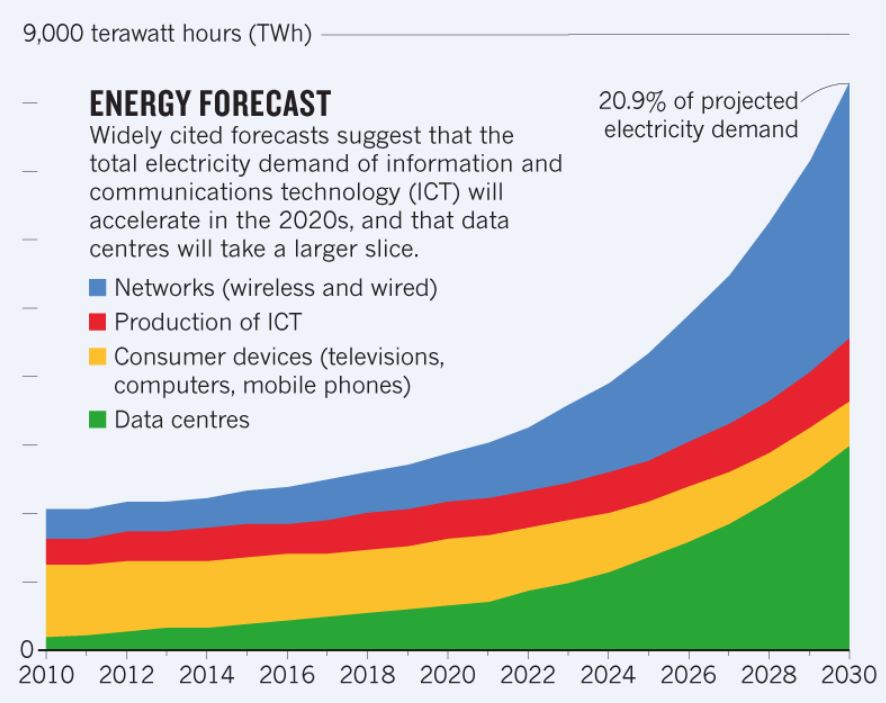

One of the sectors that is projected to consume an increasing share of the U.S. electricity supply is information and communications technology (ICT). Currently it is estimated that the share of electric power consumption by ICT is between 5 and 9% of total power demand. Currently ICT’s electricity consumption has plateaued. Increasing load from growing Internet traffic and chip technologies has been balanced by increased efficiencies. But this may change in the next few years. Forecasts suggest that the total electricity demand by information and communications technology (ICT) will accelerate and that of the ICT pie data centres will take a larger slice. The chart shows an “expected case” projection which shows that ICT consumption of electricity could reach over 20% of total demand by 2030. ICT requires a reliable and resilient power grid and will be one of the most important drivers to address the gap in investment in electric power.

One of the sectors that is projected to consume an increasing share of the U.S. electricity supply is information and communications technology (ICT). Currently it is estimated that the share of electric power consumption by ICT is between 5 and 9% of total power demand. Currently ICT’s electricity consumption has plateaued. Increasing load from growing Internet traffic and chip technologies has been balanced by increased efficiencies. But this may change in the next few years. Forecasts suggest that the total electricity demand by information and communications technology (ICT) will accelerate and that of the ICT pie data centres will take a larger slice. The chart shows an “expected case” projection which shows that ICT consumption of electricity could reach over 20% of total demand by 2030. ICT requires a reliable and resilient power grid and will be one of the most important drivers to address the gap in investment in electric power.

A related aspect of the U.S. economy is a structural shift away from energy intensive industries such as heavy manufacturing. A measure of this is energy intensity which is the amount of energy that is required to produce one dollar of GDP. In 1980 12,100 BTUs were required to create one dollar of GDP. By 2014 this had declined to 6,100 BTUs per dollar. About 40 percent of the improvement in energy intensity was attributed to structural shifts, and the remainder to improved efficiency.

Gap in investment in electric power

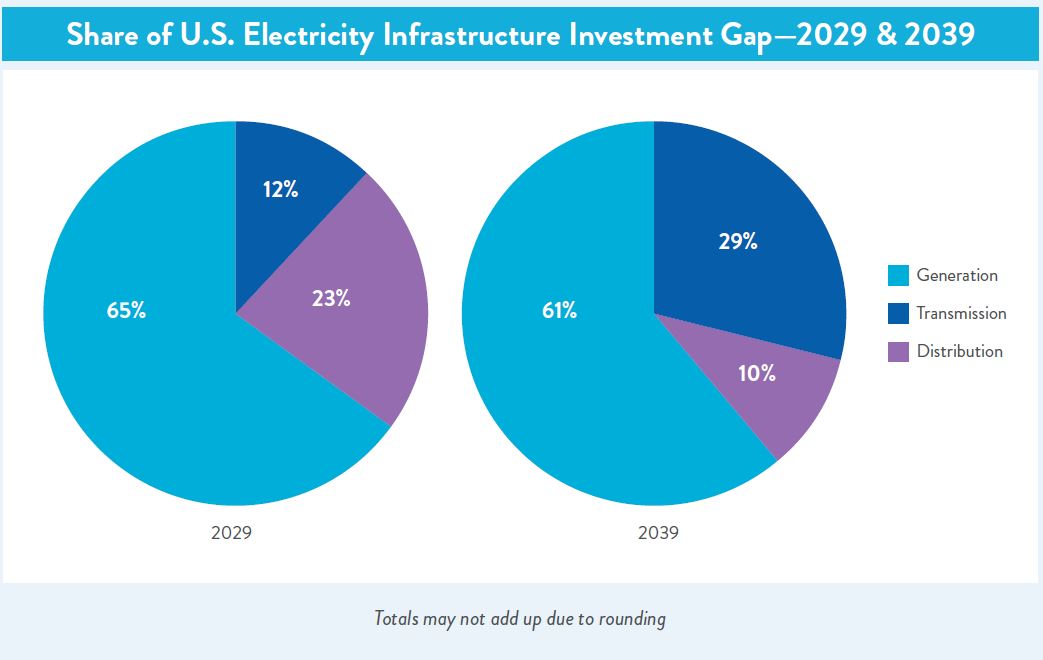

Over the period 2011-2020 demand growth estimated at about 8% has been net with increased generation capacity. But for the period 2021-2040 the report projects increasing divergence between demand and capacity. If current trends are projected into the future the U.S. is facing a $208 billion (in 2019 dollars) shortfall by 2029 and a $338 billion shortfall by 2039 in what is needed to ensure a reliable energy system. Most of this shortfall is attributed to under investment in generation and transmission. For transmission the largest challenge is not so much attracting investment in transmission, but that regulatory approval from all levels of government averages about 10 years for a new transmission line and can amount to 50% of the cost. Unlike Germany where the Bundesnetzagentur has national authority over long distance transmission lines, for bringing wind power from the North Sea to the south, for example, in the U.S. states are the top level regulatory authorities for transmission lines and a rule of thumb that has emerged is that to build a transmission line as rapidly as possible, don’t cross state boundaries. The demand for new transmission is exacerbated by the growing sources of renewable energy generation in the West that require new transmission lines to bring the power to the East and the Pacific Coast.

Over the period 2011-2020 demand growth estimated at about 8% has been net with increased generation capacity. But for the period 2021-2040 the report projects increasing divergence between demand and capacity. If current trends are projected into the future the U.S. is facing a $208 billion (in 2019 dollars) shortfall by 2029 and a $338 billion shortfall by 2039 in what is needed to ensure a reliable energy system. Most of this shortfall is attributed to under investment in generation and transmission. For transmission the largest challenge is not so much attracting investment in transmission, but that regulatory approval from all levels of government averages about 10 years for a new transmission line and can amount to 50% of the cost. Unlike Germany where the Bundesnetzagentur has national authority over long distance transmission lines, for bringing wind power from the North Sea to the south, for example, in the U.S. states are the top level regulatory authorities for transmission lines and a rule of thumb that has emerged is that to build a transmission line as rapidly as possible, don’t cross state boundaries. The demand for new transmission is exacerbated by the growing sources of renewable energy generation in the West that require new transmission lines to bring the power to the East and the Pacific Coast.

Impact on the economy

Impact on the economy

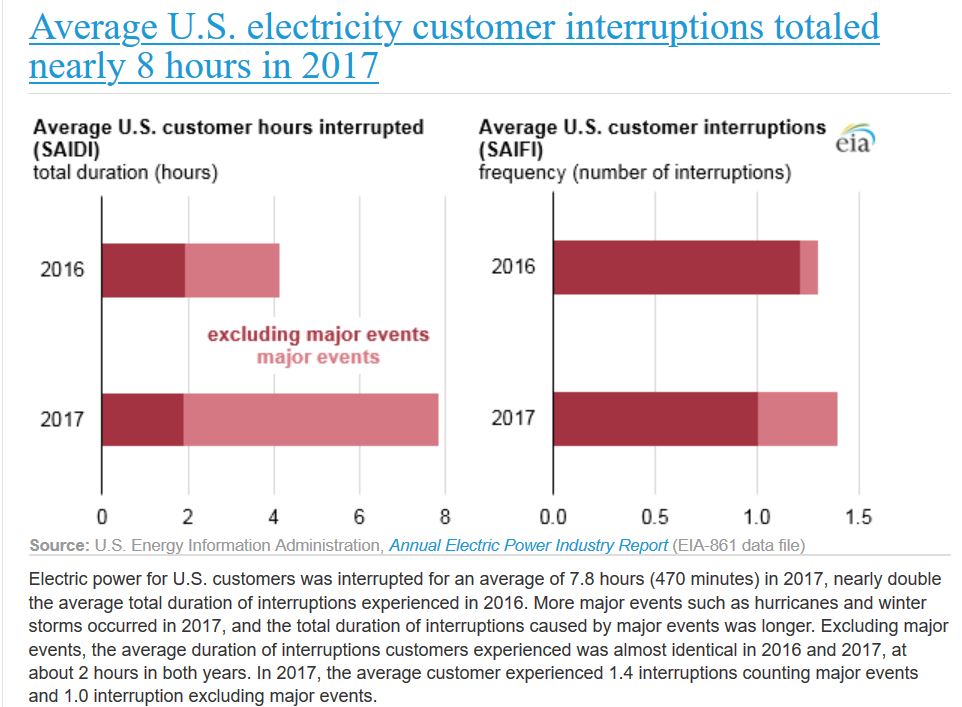

For consumers electricity system outages, voltage surges, and brownouts represent a direct cost to their households and businesses, and indirectly through impacts on the national economy. It is estimates that the cost to residential customers from each electric interruption event was $6.68 (2018 dollars). This is about twice as high as it was five years earlier partly because or our increasing reliance on chip technologies in out daily lives.

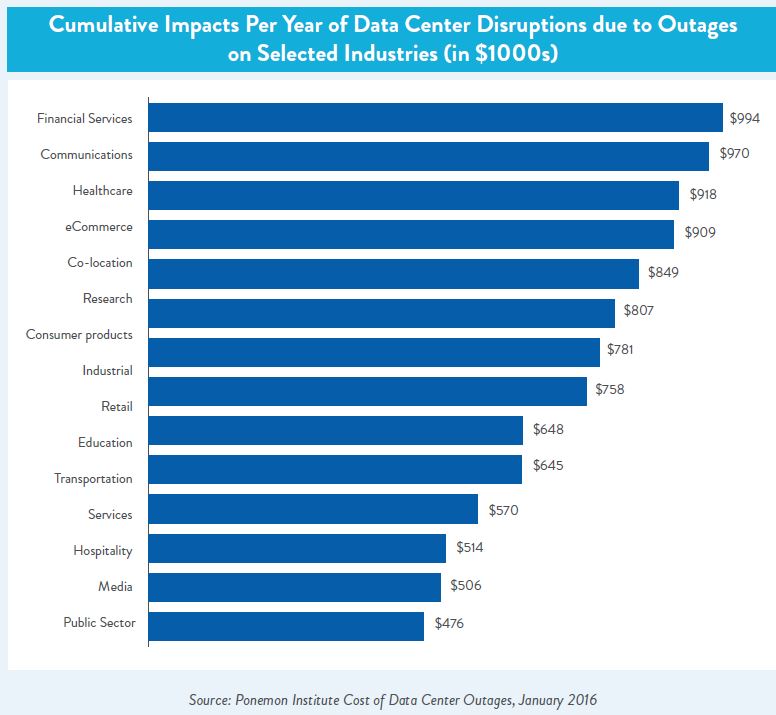

When the grid fails businesses experience downtime, lost labour and productivity. The report found that outages have the biggest impact in the manufacturing sector, costing almost $42,000 per event on average in 2008. As a result of the growing importance of ICT, data centres have become essential for many different industries. It is estimated that the average cost of an outage for a data centre increased from $505,000 in 2010 to $740,000 in 2016, or about $8,851 for every minute the electricity grid is disrupted.

When the grid fails businesses experience downtime, lost labour and productivity. The report found that outages have the biggest impact in the manufacturing sector, costing almost $42,000 per event on average in 2008. As a result of the growing importance of ICT, data centres have become essential for many different industries. It is estimated that the average cost of an outage for a data centre increased from $505,000 in 2010 to $740,000 in 2016, or about $8,851 for every minute the electricity grid is disrupted.

Furthermore, disruptions to the grid add to costs and can result in U.S. manufactured products becoming less competitive in international markets. Between 2020 and 2039, it is estimated that the gap in investment in electric power will result in the loss of $271 billion in the value of U.S. exports. In addition businesses and households will have to pay an additional $142 billion for foreign imports.

Be the first to comment