The International Energy Agency (IEA) has just released its annual World Energy Outlook 2013 with projections of energy demand and production through 2035.

Energy demand and supply

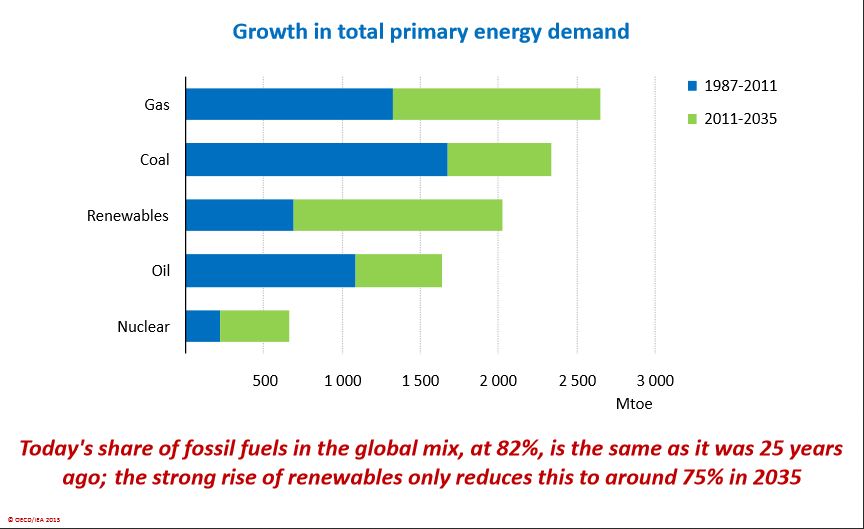

Energy demand is projected to increase by a third, driven primarily by emerging economies, China, India and the Middle East. According to the most likely scenario, China is the primary driver for increased demand through 2020, when India becomes the primary driver.

China is becoming the largest oil-importing country. India is projected to become the largest importer of coal by the early 2020s. The IEA projects that the United States will meet all of its domestic energy demand from domestic sources by 2035.

Greenhouse gas emissions

Greenhouse gas emissions

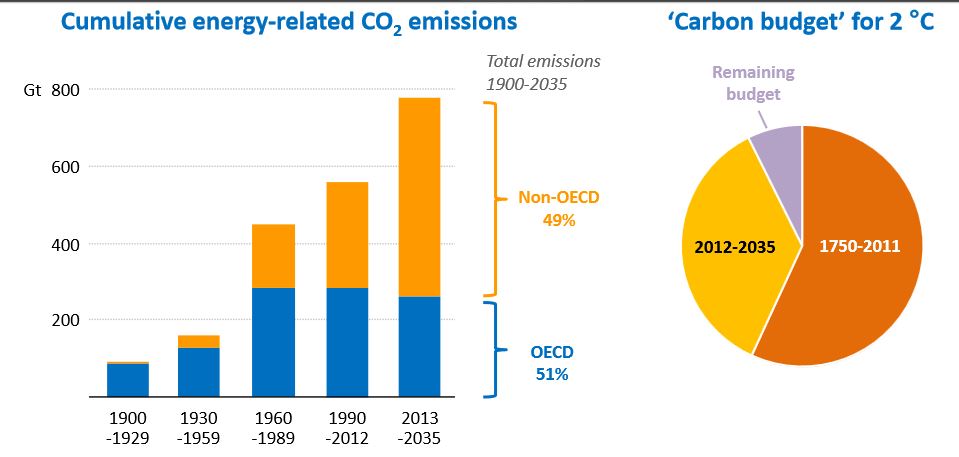

Two-thirds of global of the world’s greenhouse-gas emissions come from the energy sector. The IEA projects that energy-related CO2 emissions will increase by 20% by 2035. The IEA estimates that this will lead to a long-term average temperature increase of 3.6°C.

Energy efficiency

Energy efficiency is getting a lot of attention these days. Measures aimed at improving the efficiency of buildings have been introduced in Europe and Japan . In addition North America has been focusing on improving the energy efficiency of cars and other vehicles. But the IEA still projects that two-thirds of the economic potential of energy efficiency will remain untapped. Government action is required to break down barriers to investment in energy efficiency including phasing out fossil-fuel subsidies, which the IEA estimates has risen globally to $544 billion in 2012.

Renewables for electric power

Renewables for electric power

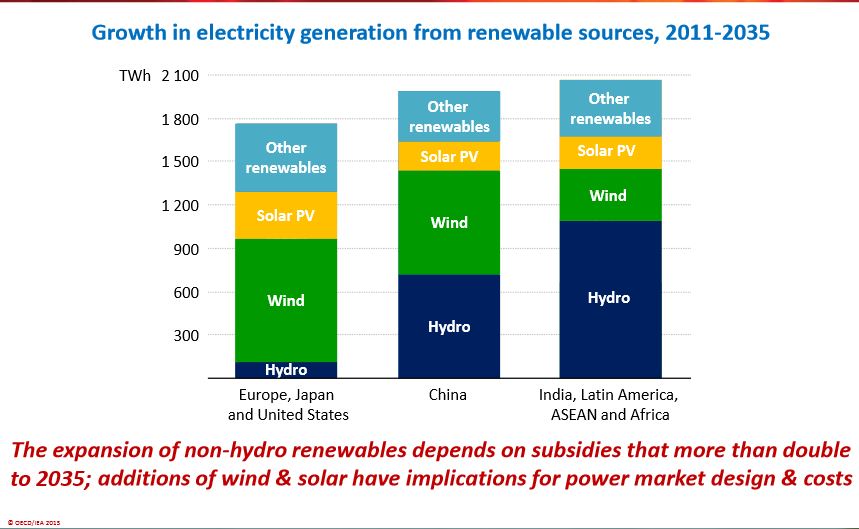

The IEA projects that renewables will account for nearly half of the increase in global power generation to 2035. Wind and solar photovoltaics (PV) are projected to be responsible for nearly half of the expansion in renewables.

The largest absolute increase in renewable energy generation is projected to occur in China. The IEA sees that in some markets (I have blogged extensively about solarPV becoming disruptive the U.S.), the rising share of renewable energy, especially solar PV, is creating business model challenges for the power industry, raising issues about about funding adequate investment and long-term reliability of supply.

The IEA projects that renewables will exceed 30% of the world’s energy mix, moving ahead of natural gas in the next few years and competing with coal as the leading fuel for power generation by 2035.

The IEA projects that nuclear power generation will increase by two-thirds, with new plants being built primarily by China, Korea, India and Russia.

The IEA also sees that capture and storage (CCS) technology could accelerate the decline in the CO2 emissions intensity of the power sector, but uncertainties about the commercial viability of CCS limits IEA projections of CCS deployment to only around 1% of the world’s fossil fuel-fired power plants by 2035.

Coal

Coal

According to the IEA, coal continues to be a cheaper option than gas for generating electricity in many regions, but the IEA expects that government interventions to improve efficiency, curtail local air pollution and mitigate climate change will be the critical in determining the future of coal. China has outlined plans to cap the share of coal in total energy use.

In the IEA most likely scenario, global coal demand increases by 17% to 2035. The IEA projects that coal demand will decline in OECD countries and expand by one-third in non-OECD countries, primarily in India, China and Southeast Asia. In China coal demand is expected to peak around 20205. India, Indonesia, China and Australia are expected to be responsible for most of the increase in production.

Natural Gas

Growth in natural gas demand is expected to be largest emerging markets, especially China, where the IEA projects that natural gas demand will quadruple by 2035, and in the Middle East. North America will continue to see a shift from coal to unconventional (shale) gas. The IEA even sees some of the unconventional gas finding its way to international markets as LNG.

The IEA sees the decline in output from currently producing fields as being a major driver for investment through 2035. The IEA projects that 790 billion barrels of total production will be required to meet demand through 2035. Of this over half will be required to offset declines in production from existing fields. For conventional fields the IEA estimates that output declines about 6% per year. For unconventional fields the annual decline is much faster. The IEA says that most unconventional plays are heavily dependent on continuous drilling to sustain output.

Energy prices and international competitiveness

Energy prices and international competitiveness

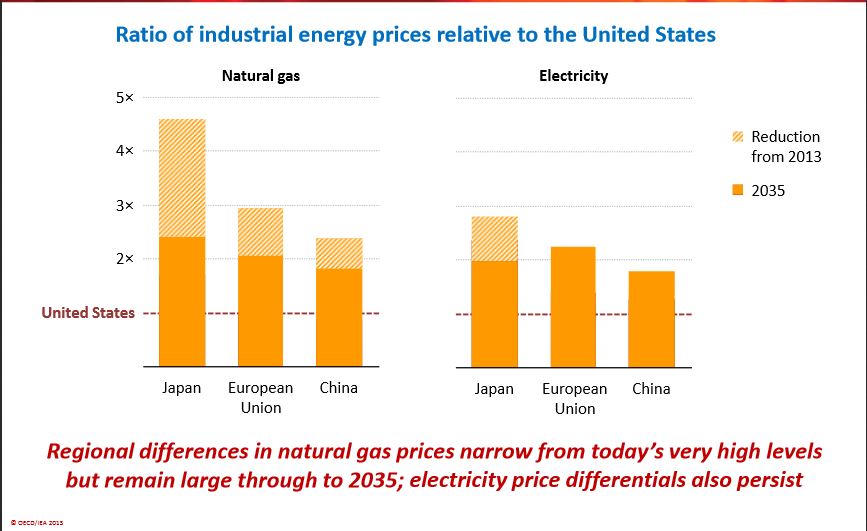

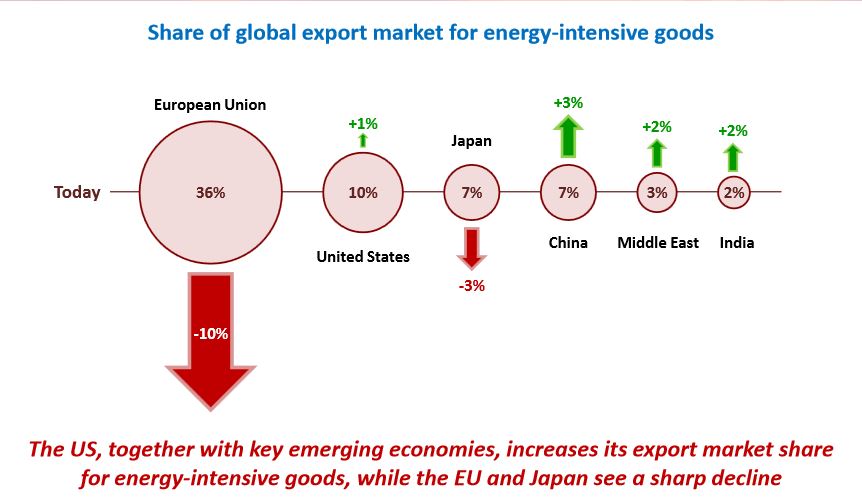

The IEA report documents the large differences in the price of natural gas and electricity in different parts of the world. For energy intensive products, this will tend to production and export from countries where gas and power costs are low, such as the United States and emerging economies.  The IEA projects that regional differences in natural gas prices will decline from the very high levels we are seeing today but large differences are projected to continue through to 2035. Significant differences in the price of electricity will also continue. Based on this, the IEA projects declining export of energy-intensive products from the E.U. and Japan and increases from emerging economies and the U.S.

The IEA projects that regional differences in natural gas prices will decline from the very high levels we are seeing today but large differences are projected to continue through to 2035. Significant differences in the price of electricity will also continue. Based on this, the IEA projects declining export of energy-intensive products from the E.U. and Japan and increases from emerging economies and the U.S.

Be the first to comment