For the first time in a hundred years, the electric power utility industry is undergoing a momentous change. Distributed renewable power generation, especially solar photovoltaics (PV), is introducing competition into an industry that has been managed as regulated monopolies. Consumers with solar PV panels on their roofs are fundamentally changing the traditional utility business model. A recent report from the Edison Electric Institute (EEI) report refers to disruptive challenges that threaten to force electric power utilities to change or adapt the business model that has been in place since the first half of the 20th century.

Most utilities are in the midst of deploying smart grids, which basically amounts to applying the internet to the electric power grid to link intelligent electronic devices, sensors and grid control applications to enable data-driven decision making. One of the most important changes driven by the implementation of smart grid is the much greater importance of location. Geospatial technology (location, geospatial data management and spatial analytics) is seen as foundational techology for the smart grid.

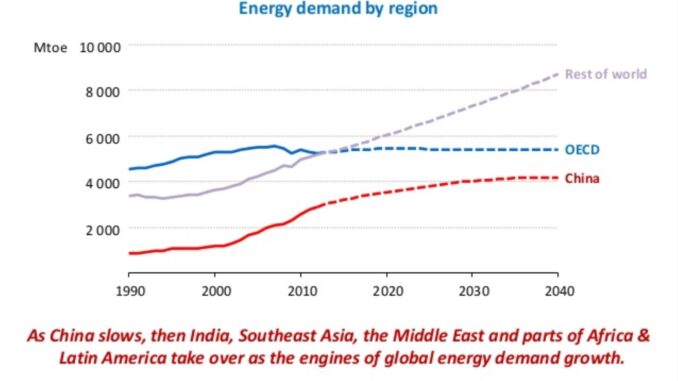

The other major global change in energy is the shift in energy demand from the world’s advanced economies to emerging economies. Energy demand from OECD countries has hit a plateau. Currently China is driving world energy demand. The International Energy Agency’s (IEA) World Energy Outlook 2014 projects that in the future as demand slows from China, world energy demand will be driven by India, the Middle East, and Africa and Latin America.

Recently IDC Energy Insights released a report IDC FutureScape: Worldwide Utilities 2015 Predictions with predictions for the future of the utility business. Some of these are startling, suggesting that the utility industry is going to experience fundamental changes in how they do business over the next few years.

New business models

IDC predicts that utilities will be looking less at generation as a source of revenue. IDC predicts that by 2018 45% of new data traffic in utilities’ control systems will originate from distributed energy resources that are not owned by the utility.

To make up for this loss of generation revenue IDC predicts that utilities will be looking for new business opportunities such as services. Specifically, IDC predicts that utilities will derive at least 40% of their earnings from new business models by 2017.

Technology

- Cloud – By 2018 cloud services will make up half of the IT portfolio for over 60% of utilities.

- Integration – In 2015 utilities will invest over a quarter of their IT budgets on integrating new technologies with legacy enterprise systems.

- Analytics – By 2017 45% of utilities’ new investment in analytics will be used in operations and maintenance of plant and network infrastructure.

- Mobility – 60% of utilities will focus on transitioning enterprise mobility to capitalize on the consumer mobility wave.

- Smart systems – By 2018 cognitive systems will penetrate utilities’ customer operation to improve service and reduce costs.

Some of the important drivers for these trends include the global redistribution of energy demand from the world’s advanced to the emerging economies, the rapid emergence of cloud-based provisioning and services, increasing regulatory pressure responding to customer demand to improve energy market transparency and competitiveness, cross-industry competition for technical, especially IT skills, smart analytics, and virtual and augmented reality beginning to be applied in business.

Top 10 technology trends

In March 2014 Gartner, Inc. identified the top ten technology trends which it saw impacting the global energy and utility markets. There is considerable overlap between IDC’s business predictions and the technology trends identified by Gartner, Inc.

Social Media

Social media are beginning to be used as a customer acquisition and retention medium, as a consumer engagement channel to drive customer participation in energy efficiency programs, a source of information about outages, and as the emerging area of crowd-sourcing distributed energy resources coordination. Social media are also being used by utilities for communicating information about outages with customers.

Big Data

Smart grid will increase the quantity of data that utilities have to manage by a factor of about 10,000 according to a recent estimate. This trend is driven by intelligent devices, sensors, social networks, and new IT and OT applications such as advanced metering infrastructure (AMI), synchrophasors, smart appliances, microgrids, advanced distribution management, remote asset monitoring, and self-healing networks. The type of data that utilities will need to manage will change: for example, real-time data from sensors and intelligent devices including smart phones and unstructured data from social networks will play a much greater role for utilities in the future.

Mobile and Location-Aware Technology

Mobile and location-aware technology which includes hardware (laptops and smartphones), communication products (GPS-based navigation, routing and tracking technologies), social networks (Twitter,Facebook and others) and services (WiFi, satellites, and packet switched networks) are transforming all industries. Utilities for the most part have been slow to adopt consumer mobile technology, but this is changing.

Cloud Computing

Acccording to Gartner, areas such as smart meter, big data analytics, demand response coordination and GIS are driving utilities to adopt cloud-based solutions. Early adopters of cloud technologies include small utilities with limited in-house IT skills and budgets, organizations which provide application and data services to multiple utilities, such as cooperative associations and transmission system operators, and investor-owned utilities (IoUs) conducting short-term smart grid pilots.

Sensor Technology

Sensors, which are being applied extensively throughout the entire supply, transmission and distribution domains of utilities, provide a stream of real-time information from which a real-time state of the grid can be derived.

IT and OT Convergence

Virtually all new technology projects in utilities will require a combination of IT and OT investment and planning, such as AMI or advanced distribution management systems (ADMSs). This will be a challenge for many utilities, especially smaller ones, which don’t have in-house IT skills.

Advanced Metering Infrastructure

AMI provides a communication backbone aimed at improving distribution asset utilization and facilitating consumer inclusion in energy markets.

Internet of Things

Sensors and actuators embedded in physical objects are linked through wired and wireless networks, using the same Internet Protocol (IP) that connects the Internet. When intelligent objects can both sense the environment and communicate, they become tools for understanding utility grids and responding to changes in near real-time. Following McKinsey there are two key benefits arising from the Internet of Things for utilities

- Enhanced situational awareness – acheiving real-time awareness of physical environment, in this case, the grid

- Sensor-driven decision analytics – assisting human decision making through deep analysis and data visualization

Asset performance management

Traditional asset management approaches are too limiting for today’s performance-based, data-driven utility environment. Asset performance management solutions need to deliver real-time equipment performance, reliability, maintenance and decision support for effective resource management so that operations and maintenance teams are empowered with real-time decision support information, providing the right information to the right people at the right time and in the right context. The result is improved operational performance and better asset availability and utilization.

Business Intelligence and Advanced Analytics

Analytics will become essential as the volume of data generated by intelligent devices and sensors, mobile devices (the Internet of Things) and social media increases and huge pools of structured and unstructured data need to be analyzed to extract actionable information. Analytics will become embedded everywhere, often invisibly.

Be the first to comment