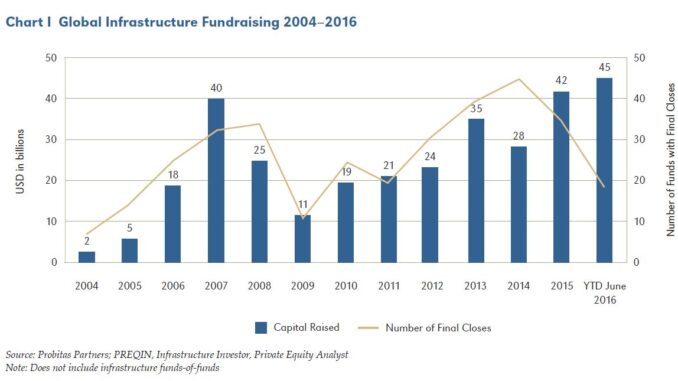

Until 2004 almost all the funding of investment projects was by governments and traditional lending institutions, primarily commercial banks. Pure financial investors were almost absent as equity investors in major infrastructure projects. Global infrastructure fundraising for private equity investments in infrastructure began in 2004. In 2007, just before the global financial crisis, this type of fundraising had reached $39.7 billion. This was 15% of the total infrastructure project finance loans that year. After the financial crisis, fundraising for private equity investments dropped significantly to about 10.5% of total project finance loans. Fundraising set a post-Great Financial Crisis (GFC) high in 2015, but the midyear total for 2016 already exceeded that.

Sources of private equity

The primary pure financial investors in equity for infrastructure are pension funds, sovereign wealth funds, and insurance companies. According to the OECD, total assets held by pension funds globally was US$ 16.2 trillion. The top 70 insurance companies hold $20.7 trillion in assets. Sovereign wealth funds hold an estimated $7.3-7.4 trillion in assets.

The OECD has estimated that the total commitment of pension funds to infrastructure in 2008 was $400 billion, primarily utilities, but with around $60 billion invested in infrastructure other than utilities. An OECD survey of large pension funds in 2013 showed that some funds had allocated important percentages to infrastructure.

The majority of sovereign wealth funds have infrastructure investments. A recent paper reported that with total assets of $5.2tn at the end of 2012, sovereign wealth funds had invested $52 billion in infrastructure between 2005 and 2012. In 2013, the OECD surveyed a sample of the most important sovereign wealth funds worldwide and found that the percentage allocation of assets to infrastructure was signifiant with some reaching 10 – 12% of assets.

There are about 200 insurance companies worldwide with investments in infrastructure. Most of these are located in Europe and the USA, with about 20% of them in Asia. Insurance companies typically invest in primary equity.

The Towers Watson and Financial Times’ Investor Survey 2013 reported that, out of the $3.1 trillion total assets under management by the top 100 investment asset managers, $127.6 billion was invested in infrastructure. It was also found that pension funds and sovereign wealth funds were the most heavily invested in infrastructure with 9% and 10% of their total assets, respectively.

According to the Willis Towers Watson Global Alternative Investment Assets Survey 2016, almost all private financial institutions are either not yet invested in infrastructure or are below their target allocation, but the demand is there. According to Willis Towers Watson, “the reality is that the requirement for private investment in infrastructure is immense in all geographic regions.”

Sources

Private Equity Institutional Investor Trends for 2016, Probitas Partners

PRIVATE FINANCING AND GOVERNMENT SUPPORT TO PROMOTE LONG-TERM INVESTMENTS IN INFRASTRUCTURE

Global Alternative Investment Assets Survey 2016 – Report Summary

Be the first to comment