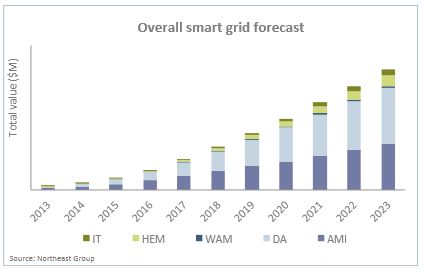

A recent Northeast Group report forecasts that the total smart grid market in South America will cumulatively reach nearly $50 billion by 2023. The primary areas for investment include advanced metering infrastructure (AMI), distribution automation, wide area measurement, home energy management, and information technology (IT). This estimate for the market size has increased since the last South American smart grid market forecast.

This study covers Brazil, Chile, Colombia, Argentina, Ecuador, Peru, Paraguay, Uruguay, Venezuela, and Bolivia. As a whole South American economies are rapidly growing with an increasing middle class. Most have access to vast renewable power, especially hydro power. For example, 25% of Brazil’s power derives from one hydro dam, Itaipu with a capacity of 14 GW, (second only to Three Gorges in Chiina). Another 11 GW hydro project almost as large is underway in Brazil at Belo Monte.

The major challenge in most of South America is non-technical losses, which accounts for 15.5% of total electricity demand. For example, electric power demand has been increasing in Brazil at a rate above

the average world rate. Between 1980 and 2000, Brazil’s electricity

demand increased on average by 5.4 % per year. But it has been estimated that up to 30-40% of Brazil’s electric power consumption is non-revenue generating.

Throughout South America, non-technical losses is a major motivator for smart grid. According to the Northeast Group study eight of the ten countries have significant pilot projects in place, with Brazil leading with pilot projects starting in the mid 2000s. Brazil already has over one million smart meters deployed.

Last year Brazil’s energy regulator ANEEL released specifications for smart meter deployment. ANEEL did not mandate a general smart meter rollout, but defined a set of guidelines to achieve three objectives.

- Improve energy service to consumers, ANEEL requires utilities to supply precise geographic information about the location of cables, transformers and customer metering points. The objecive is a unifom way of asset tracking and inventory maintenance.

- Increase photovoltaic, wind, biomass, hydro and cogeneration resources, ANEEL seeks to make it easier to connect distributed micro-generation (up to 1 MW) to Brazil’s power grid. Implementing net metering, via smart meters, is an important part of this strategy.

- Implelemnt time-of-use rates to give consumers the option to save money by shifting energy use to off-peak periods..

Ecuador has set a more ambitious timeline for smart grid deployments. Colombia and Peru are finalizing smart grid roadmaps. Chile is developing its own smart city projects, Argentina is funding smart grid R&D, and even Paraguay is developing smart meter pilot projects. In addition to AMI, distribution automation is also important forl South American utilities because of frequent outages.

Be the first to comment