In the U.S. there are about 540 coal plants which generate a bit less that half of all US power, that’s roughly half of 1000 GW. More than one third of U.S. coal-fired facilities are more than 40 years old, their expected lifespan. The EPA’s released MATS standard which requires compliance in three years and the projected EPA CO2 emissions standard are forcing power utilities to decide now whether to try to reduce emissions from their coal fired plants or to replace them with natural gas-fired turbines, nuclear power or other technologies. About 26 GW of coal-plant decommissioning has already been annnounced. At the recent APPA conference in Seattle, many utilities were looking at alternatives to coal including natural gas, hydro, small modular nuclear, and renewables like solar and wind.

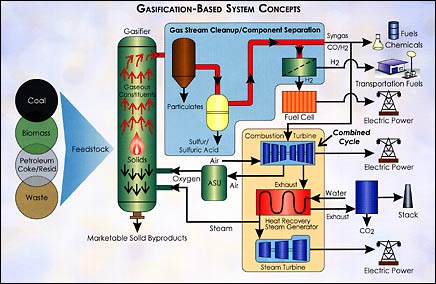

If they decide to reduce emissions by retrofitting their coal-fired plants, they can consider several options. Three years ago I blogged about some of the alternative technologies for “greening coal”. These include pre-processing option, for example, coal gasification, oxy-combustion, or post-processing, for example, capturing emissions and storing them underground. At present there are no plants in production using these technologies.

As an example, Duke Energy will be retiring about 3 GW of older coal units because it has decided that it does not make economic sense to retrofit them to reduce emssions. Duke is replacing the plants with two natural gas combined cycle (NGCC) plants and is also converting an existing coal plant in Indiana to a coal gasification facility.

In 2005 the DOE announced the $1.3 billion FutureGen project to design, build and operate a nearly emission-free coal-based electricity and hydrogen production plant. The was to be based on coal gasification (IGCC). In August 2010 DOE said that it was abandoning the original FutureGen idea and announced FutureGen 2.0. This project would involve retrofitting one unit at Ameren’s plant in Meredosia, Illinois, with oxy-combustion. The plant would burn pulverised coal and capture over 90% of the CO2 produced. A pipeline will link it to a regional CO2 storage hub with final sequestration in the Mt Simon Formation. Construction is scheduled for 2012 to 2015 with the plant on line in 2016.

Duke Energy is building a $3 billion, 618 MW, integrated gasification combined-cycle (IGCC) plant at Edwardsport, Indiana. In the gasification process, coal is partially burned to produce gases, mostly H2 and CO, which are burned in a gas-turbine to produce electric power. The effluent from the gas-turbine is then used to produce steam which drives a steam-turbine generator. The estimated cost of the conversion is $3 billion, but because this is a regulated plant, the amount the ratepayers are responsible for is supposedly capped at $2.59 billion. At this point there is uncertainty about the final cost of the project and whether it will ever be in production.

The Texas Clean Energy Project (TCEP) at Penwell is a 377 MWe IGCC power plant burning coal with CCS, capturing 90% of CO2 and 90% of NOx. It will have $450 million funding from DOE Clean Coal Power Initiative towards its $2.4 billion cost. It is due to operate from 2015. Of the 377 MWe, 106 MW will be used to run major project equipment on site, 16 MW will be used to compress CO2, and 42 MW will be used to produce urea, leaving 214 MWe for the grid.

Economics

In 2006 the IEA identified that major barriers to CCS deployment are cost, demonstration of commercial operation and safe permanent storage. Typical cost of CCS in power plants range from US $30 to 90/tCO2 or even more, depending on technology, CO2 purity and site and CCS requires an investment of hundreds of millions of dollars for a single power plant.

Be the first to comment