Don’t forget who got you where you are. Hint: it’s the customers…

The growth of the industry, as well as the firms that support geomatics and geospatial communities, has been overall a positive thing. Successful firms have been able to sink more into R&D, grow sales, support, and service ecosystems. In addition, the expansion of user bases fosters communities of peer practitioners that can provide feedback to help inform the direction of the large-geo-vendors.

Waves of Growth

There have been successive waves of change, particularly in specific technologies, that have seen the rapid rise of various large-geo manufacturers and vendors. We’ve seen the rise of large-geo firms that are synonymous with these waves: the opto-mechanical revolution in surveying instruments in the early 20th century, to the electro-optical and satellite navigation developments in the latter half of the same century; the rise of certain geo-manufacturers coincided with those developments Then, the 21st century booms of reality capture, process automation (AI et al), and more. Remember when IBM epitomized the rise of computing, Kodak in consumer photography, and the “Big 3” in automotive?

We in the end-user community for geomatics and geospatial products and services had been fortunate that, in comparison to other sectors, the big and small vendors mostly chose folks for leadership roles who were practitioners of, or had solid backgrounds in, geomatics, surveying, construction, and/or other geospatial disciplines. It was reassuring to know that the folks making decisions about what is designed and produced had also spent some time in muddy fields, lugging heavy instruments…. In short, they can relate to end users. And, in many cases, the R&D arms of large-geo, especially for the foundational tech that gave them their start, have remained top-of-the-class (though expansion into new fields has sometimes yielded mixed results).

Change of Focus?

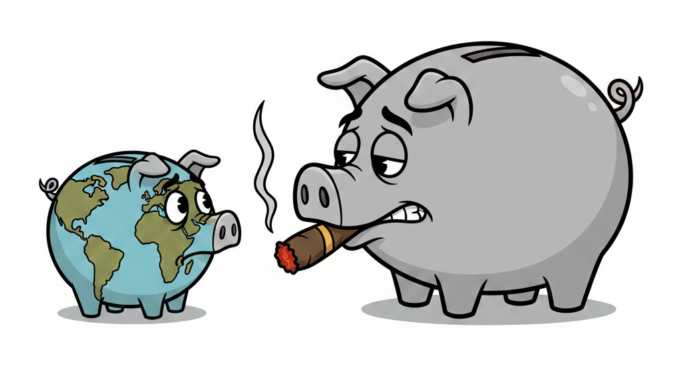

However, once a firm becomes a very-large-geo concern, has gone public, and/or has a lot of external investors, its focus may have changed—whether they recognize it or not. The geo-practitioners that dominated the firm’s management ranks during foundational and rapid growth periods are steadily being replaced by folks with finance backgrounds. No, I’m not going to name names (the climate is a bit too litigious). They may not recognize that, for instance, the foundational tech that made the company boom in the beginning is no longer a near-monopoly; the cat is out of the bag, and others can now do it faster, cheaper, and sometimes, better. Clinging to exorbitant pricing structures may not be sustainable.

“Never forget where you’re from. It’s essential to remain humble and evolving.” – Freida Pinto.

While it is possible for a geo-vendor to expand without losing focus on the end-users’ needs (there are several fine examples of this), some of the big names are becoming more distant from the end users. And in some cases, they are steadily losing customers to upstarts, who are following models from their own early, pre-mega-geo days.

Some of the humungo-geo vendors are still doing a great job of keeping the focus where it should be, like Bentley Systems, Esri, and Leica Geosystems. And, many geo-upstarts are growing the right way, like CHCNAV, Stonex, Tersus, Looq, Freefly Systems, and more.

In comparing notes recently with other geomatics folks (who have been in the biz as long as I have), we’re seeing symptoms of the “very-big-geo” (or perhaps “too-big-geo”?) trend.

I’ll give a few anecdotes, as I found out that others have been experiencing similar, from various large-geo-vendors:

A (Kind of) Shakedown

There are several large-geo-vendors with which I’ve done a lot of business, for several decades, on behalf of projects or clients. Investments, in some cases, have been substantial. Relationships with these large-geo vendors have mostly been exemplary; mutual respect and recognition of real-world challenges and limitations.

Then, out of the blue, some sales folks from one of the largest-geo vendors called to set up an in-person meeting; they planned to fly in but were a bit evasive on the subject. I kept thinking: “What has changed that they need to suddenly meet in person?” I deflected and proposed, instead, an online meeting. I kind of had an idea of what they might ask, and yep…

The subject was why my current-year purchases were much lower than normal; they wanted to ask about my budget. Whoa… no customer should have to go before the mast to explain their budget decisions. There are other aspects to budgets that might hit on specific years that otherwise would not: staffing levels, investments in other infrastructure (e.g., IT), training, aging out of other equipment and systems, etc.—we should not have to justify this to vendors. I know these folks, and they are otherwise very polite and respectful, so they must be feeling pressure from folks up the sales chain. And those folks, in turn, must be feeling pressure from further up the management chain, with further pressure for the executives and board.

I don’t blame the folks who were tasked with executing what was in effect, for lack of a better term, a shakedown. No, they’re just caught up in the machinations of a firm that grew large (which is not always a bad thing) but lost some of the unwritten magic that helped them grow in the first place.

Then there was the tactless new hire (same firm) at a conference who got in my face and told me that practitioners like me would be replaced by AI. No one is denying that AI is, and will continue to, have an impact on the sector, the types of work folks do, and who will be doing them. True or not, being that blunt with and mocking long-time customers is not a good look for a company.

“The customer’s perception is your reality. What they think about your products matters. If you don’t put your customer’s perception first, the game is over.” – Sharfaraz Ahmed.

Echo Chambers

Another example has to do with independent feedback. Large-geo firms have broad communities of end-users from which to mine feedback, and for the most part, they do. Yet, some large-geo-vendors are not attracting as much independent insight as they used to. A potential customer would rather hear from fellow practitioners than corporate (or AI) content generators. Several of the large-geo vendors have alienated the community of independent geo-writers. This even goes as far as treating them begrudgingly when they request interviews, product details, and connections to customers for case studies.

Remember when there were numerous industry-focused publications with independent content? Vendors would go out of their way to be featured. Now, there’s so much paid content (and thinly veiled paid content) that the appeal has diminished, not to mention a dearth of impartial views. Independent geo-writers are increasingly being treated like vermin by some large-geo outfits. Some, though, have maintained good relations with the geo-writers, but many have not. Echo chambers are not a good look for the geospatial industry.

All is not lost. The sort-of-falling-star of some of the bigger-geo-vendors opens room for newer firms, provides more choices for end users, and gives the profession leverage, informing (those who will listen) what our evolving needs are. And many of these new players know that they must not take customers for granted. Your firm may recognize that, technology wise, you stood on the shoulders of giants. But your success, ultimately, came from also standing on the shoulders of humble customers.

Be the first to comment